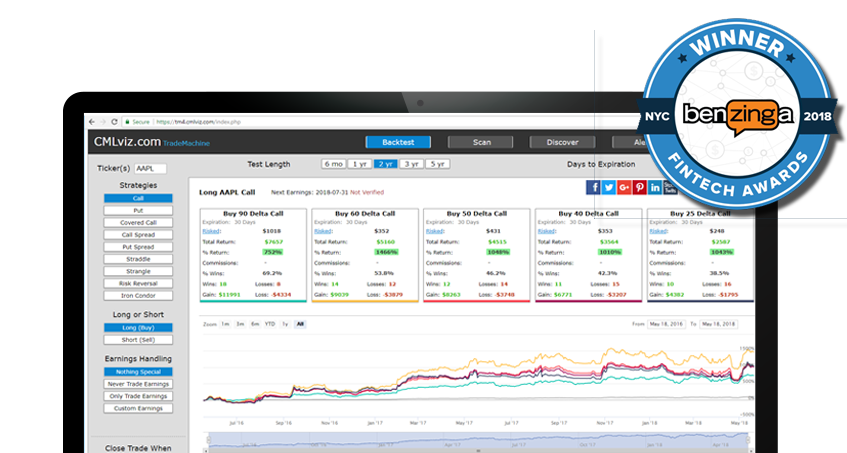

Options Trading Software

TradeMachine Pro is the options trading software and option backtesting tool that every professional trader would rather you don’t see.

VIEW LIVE DEMO EXPLORE FEATURES

Get options trading ideas from the experts at Capital Market Labs right in your TradeMachine PRO dashboard. Save days and weeks of research with solid, well-researched trades that you can't get anywhere else.

The CML team creates dozens of options trading strategies, and the software runs them daily against all of the stocks in the market. Sort and filter backtest results, and see when the next earnings event is coming up.

Enter 1-5 stock tickers, and set a backtesting timeframe and options expiration period. Get strategies, earnings handling, and technical signals that narrow your trades down to only the best-performing options.

Never miss a trade opportunity again with TradeMachine PRO notifications. Get custom text and/or email alerts for specific technical indicators, earnings dates, and more, delivered to your phone or your dashboard.

Get Options Trading Strategies from The Experts

WATCH THE VIDEO >>

Trusted Globally

Join the thousands of traders using TradeMachine PRO who crush the options market and discover profitable trades daily.

With informed, science-based research, now it's easy to trade options like a professional.

"Most of my trades were relatively small, each risking a total of maybe $1000-$1500 or so. I took out $750 cash from profits and my net $30,681.56, which brings the total net profit of $31,431.56 with all trades closed. I started 2 1/2 weeks ago. SO THANK-YOU!!! ".

TradeMachine PRO User, Jan. 2018

"Thank you so much. This is the coolest site I've ever seen. I have been trading futures, options and stocks since 1995 and have never seen something close to this."

TradeMachine PRO User, Feb. 2018

"Less than 2 weeks ago I bought 2 calls each with both January and March expirations. Well, today alone, those calls are up almost $1,200. Combined, they are averaging just over 100% profit. I can't say enough how much you have changed my perspective on trading.

TradeMachine Pro User, Nov. 2017

We Are All Traders

We are all looking for opportunity.

We're the "anti-institution" solution.

As a member of the famed Thomson Reuters First Call, our research sits next to Goldman Sachs, JP Morgan, Barclays, Morgan Stanley and every other multi billion dollar institution. But while they pay upwards of $2,000 a month on their live terminals, we level the playing field and bring day traders the same technology for much, much less.

Limited Time Offer

$129/mo

Act now and lock in this special offer.

If for any reason, you are not completely satisfied, let us know within 30 days of purchase and we will refund you 100%.

Money Back Guarantee

No Questions Asked. It's That Easy.

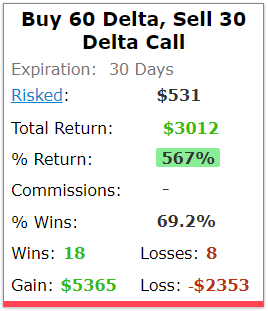

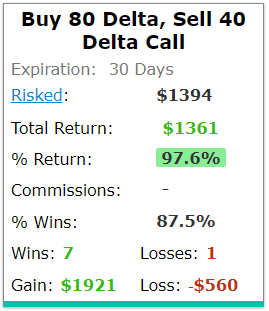

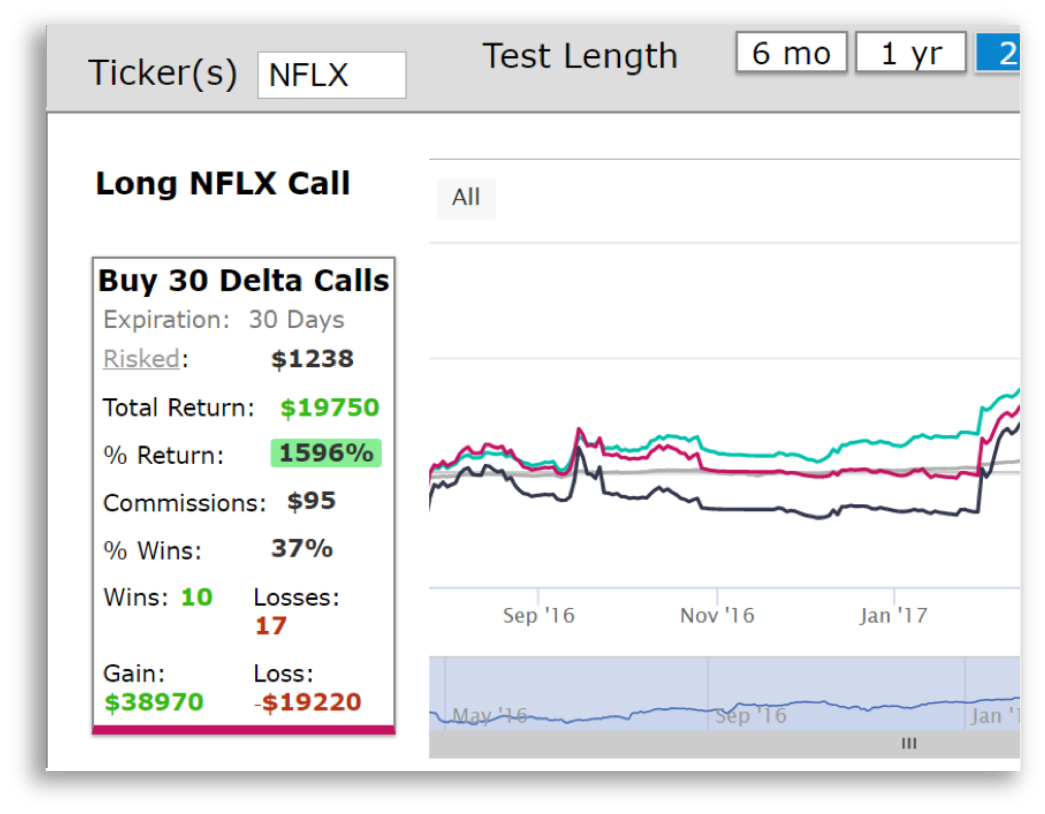

Get Institutional Caliber Research and Profit From Trades Like These Every Day:

FB Call Spread

NVDA Earnings Call Spread

Long APPL Call

What's Included With TradeMachine PRO

TradeMachine PRO is not just options trading software. Your monthly SaaS subscription includes set-ups, ideas, & analysis you can't find anywhere else. Cancel anytime.

Weekly Researched Trade Set-Ups

Get our thoroughly researched top picks from stocks like BAC, AAPL, and NFLX, as well as ETFs like SPY, XLU and even the famed VXX.

The software does the heavy lifting.

New Trade Analyses and Ideas

Get 3-10 new trade analyses, set-ups and ideas that are meant to further your knowledge of trading and keep you apprised of what’s happening in the market — from mega cap tech stocks to utilities, industrials, ETFs and indices.

Price Lock-In for Life

This time-sensitive promotion lets you lock in your pricing of TradeMachinePro for life. As a way of saying thanks, we'll include more than a dozen trade set-ups in your welcome email so you can hit the ground running.

Finally, a backtesting tool you can count on.

The options backtesting tool is one of the most powerful features of TradeMachine Pro. Enter 1 to 5 stock tickers, a time frame for backtesting, and an option expiration date, then watch our options trading software do the analysis.

Viewing different strategies, earnings handling, and technical signals that help narrow down your trades to only the most profitable, solid performing options.

We've Brought In The Big Guns

Meet the Capital Market Labs Team

Founders and Lead Strategists Behind TradeMachine PRO

Ophir Gottlieb, CEO

As one of the most influential options traders in today's market, we could devote a whole website to Ophir's credentials!

Not only is he one of the earliest scientists to identify deep learning, and in particular, neural networks, as a novel approach to examining financial markets.

Mr Gottlieb’s mathematics, measure theory and machine learning background stems from his graduate work in mathematics and measure theory at Stanford University and his time as an option market maker on the NYSE and CBOE exchange floors. He has been cited by various financial media including Reuters, Bloomberg, Wall St. Journal, Dow Jones Newswire and through re-publications in Barron’s, Forbes, SF Chronicle, Chicago Tribune and Miami Herald and is often seen on financial television.

James A. Kaplan,Chairman

Mr. Kaplan is a founding director of MarketWatch, and is widely recognized as one of the grandfather’s of modern portfolio theory.

For the past 20 years, James Kaplan’s research interests and entrepreneurial ventures have focused on innovations designed to improve the predictive and explanatory power of classical finance theories and portfolio management philosophies.

Before he co-founded CML, Mr. Kaplan as Vice Chairman and Chief Executive of GMI Ratings (now part of MSCI). In this role, Mr. Kaplan developed novel risk modeling methodologies to help capital market participants mitigate the impact of what he has dubbed “routine anomalies”. The term refers to high-impact events stemming from variables typically overlooked in classical economic theories.

Jason Hitchings, CTO

Jason Hitchings is the Chief Technology Officer at CML. He has diverse background in software engineering, product development, data visualizations as well as numerical analysis and real-time algorithmic option pricing.

He was the lead developer and product manager that led to one of the first ever SQL databases that updated asset prices in real-time; an accomplishment at the time that was considered by many in the industry to be impossible but is now common place in all of the exchanges and major banks in the world. Jason’s experience includes Head of Product at data visualization firm, Quid, the co-founder and lead engineer of financial analytics firm and broker-dealer, Livevol, Inc. Jason has also worked as the lead software engineer on Lockheed Martin’s Joint Strike Fighter Autonomic Logistics team.

Tom White, Data Scientist

As Director of Quantitative Research for Audit Integrity (now part of MSCI) Tom applied predictive analytic techniques to model accounting fraud and securities class action litigation. Mr. White led the Analytic Science team at KUITY in ground breaking work applying ‘Big Data’ techniques to the field of philanthropy, ultimately resulting in the creation and spinoff of Posiba, Inc. As a consultant at First USA Bank, Mr. White’s team was an early analytics adopter, using predictive models to optimize marketing efforts, increasing profits from 3rd party products by over 250% in just 24 months. He is considered an expert at options trading software.

Mr. White received his B.A. in Economics from the University of Virginia and a Certification in Data Mining from the University of California, San Diego.